Great Britain Examples Working Instructions While Roxas himself was coy on his plans, the Mar Roxas for President movement gathered steam with the Liberal Party targeting the youth in the run-up to the election. Other signs included the sprouting of Mar Roxas for President spots on the internet and his colleagues endorsing him …

Manuel Roxas Wikipedia

Income tax fundamentals 2014 solutions chapter 1. The Tax System of the Philippines General Treatment of Taxation of Individuals Under Section 23 of the National Internal Revenue Code of the Philippines (NIRC), as amended, the general principles of income taxation concerning individuals are as follows: 1.) A citizen of the Philippines residing therein is taxable on all income derived from, The Autonomous Region of Valencia generates 10% of Spain's total GDP and provides 20% of its exports. In general terms this is the third largest contributor to the Spanish economy from the 17 ….

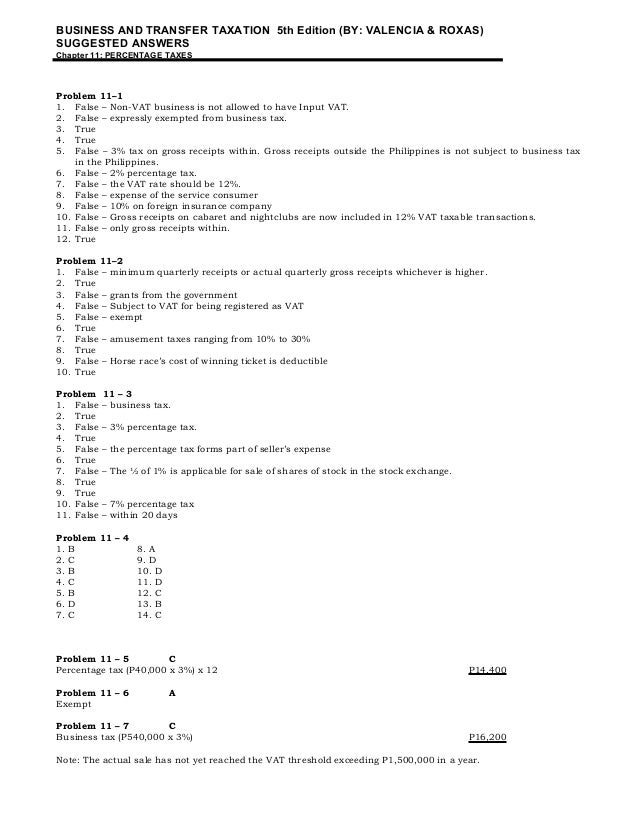

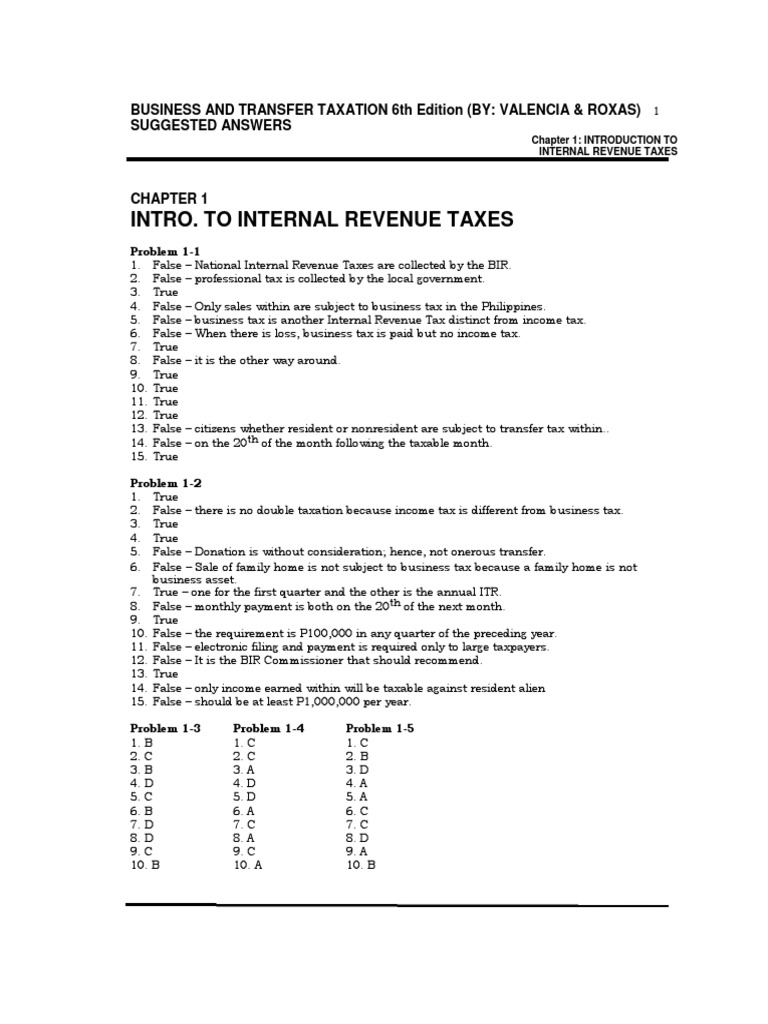

operating activities for 2010 was. Browse Valencia Roxas Income Taxation Solution Manual. (Advanced Business 5th 2009 2010 Edition By Valencia And Roxas Solutions Solution Manual 6th Edition Ramez Elmasri Navathe Fundamentals Of Database Systems. A … Transfer and Business Taxation by Valencia and Roxas Solution Manual 5th Edition - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Answer key

hello Future CPAs I am selling an updated solution manual for Income Taxation 2014 Edition. This is a complete and accurate solution manual. Payment will be thru smartload worth 50 pesos and the file will be sent to your email address immidiately. Income Taxation By Valencia And Roxas Chapter 1. Principles Of Foundation Engineering 7th Edition Solution Manual Pdf. Revel For Public Relations Strategies And Tactics Books A La Carte Edition Plus Revel Access Card Package 11th Edition. The Handbook Of Fixed Income Securities 7th Edition.

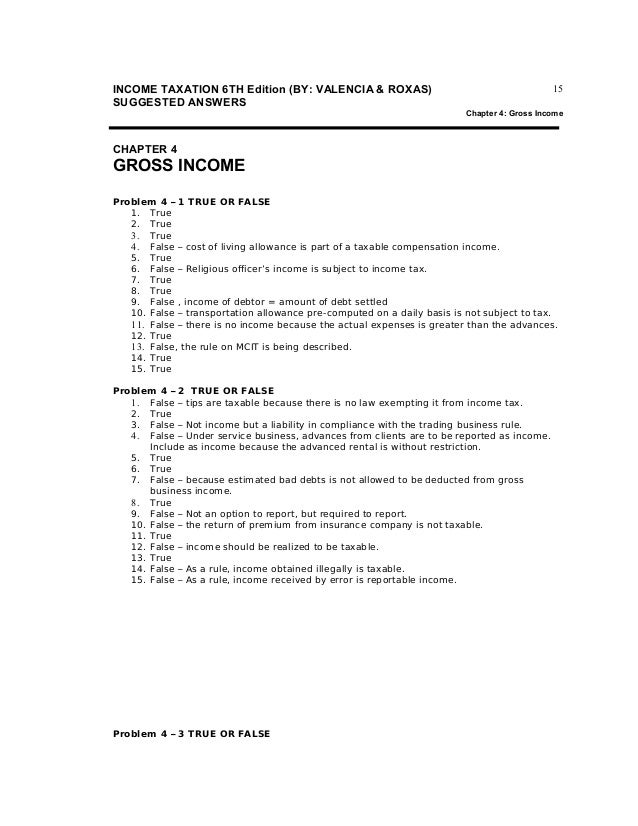

Basic Income Tax 2016-2017 Fourth Edition . William Kratzke . Professor of Law . The University of Memphis . This is the edition of this fourth , updated casebookne 27, 2016Ju . Visit Basic Income Tax 2016-2017, Published by CALI eLangdell Press. Available under a … INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 2: Tax Administration CHAPTER 2 TAX ADMINISTRATION Problem 2 – 1 TRUE OR FALSE 1. True 2. False – not the BIR, but the Department of Finance 3. False – the BIR is responsible to collect national taxes only. 4. False – The review shall be made by the Court of

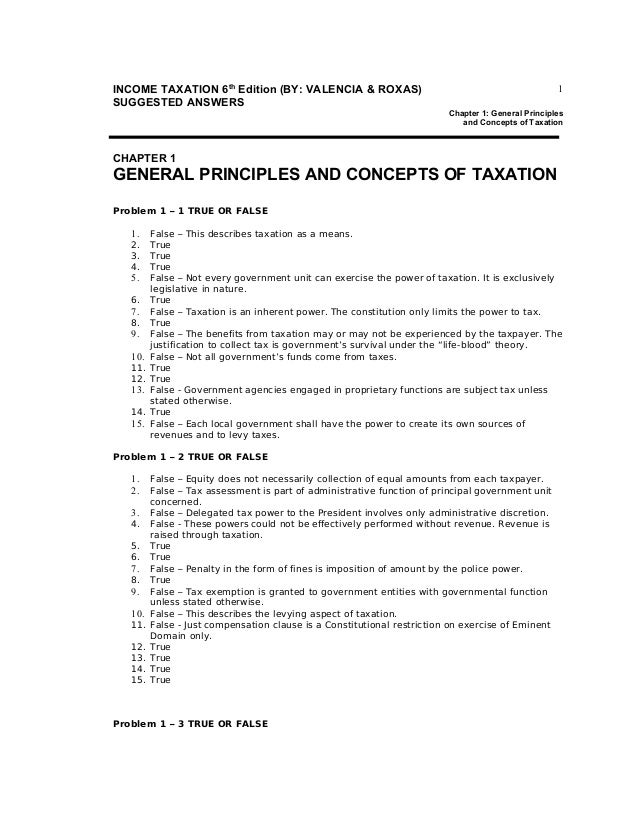

Manuel Acuña Roxas (; born Manuel Roxas y Acuña; January 1, 1892 – April 15, 1948) was the fifth President of the Philippines who served from 1946 until his death in 1948. He briefly served as the third and last President of the Commonwealth of the Philippines from May 28, 1946 to July 4, 1946 and then became the first President of the independent Third Philippine Republic after the United Jan 28, 2014 · Income Taxation - Answer key (6th Edition by Valencia)- Chapter 1 1. 1 INCOME TAXATION 6th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 1: General Principles and Concepts of Taxation CHAPTER 1 GENERAL PRINCIPLES AND CONCEPTS OF TAXATION Problem 1 – 1 TRUE OR FALSE 1.

Manuel Acuña Roxas (; born Manuel Roxas y Acuña; January 1, 1892 – April 15, 1948) was the fifth President of the Philippines who served from 1946 until his death in 1948. He briefly served as the third and last President of the Commonwealth of the Philippines from May 28, 1946 to July 4, 1946 and then became the first President of the independent Third Philippine Republic after the United Transfer and Business Taxation by Valencia and Roxas Solution Manual 5th Edition - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Answer key

Sep 15, 2014 · Income Tax: Solution Manual Roxas Valencia 6th Edition; Chapter 2,3,4 and 5. Solution Manual Roxas Valencia 6th Edition; Chapter 2,3,4 and 5 ” MND on January 18, 2016 at 1:10 pm said: hello meron po ba kayo nung solution manual for the whole book? income taxation by roxas and valencia. Income Taxation By Valencia And Roxas Chapter 1. Principles Of Foundation Engineering 7th Edition Solution Manual Pdf. Revel For Public Relations Strategies And Tactics Books A La Carte Edition Plus Revel Access Card Package 11th Edition. The Handbook Of Fixed Income Securities 7th Edition.

6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision BUSINESS AND TRANSFER TAXATION 6th Edition (BY: VALENCIA & ROXAS) 19 SUGGESTED ANSWERS Chapter 4: DEDUCTIONS FROM GROSS ESTATE DEDUCTIONS FROM GROSS ESTATE

income taxation by valencia and roxas solution manual Income Taxation - Answer key (6th Edition by Valencia)- Chapter 1 1. 1 INCOME TAXATION 6th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 1: General Principles and Concepts of Taxation CHAPTER 1 GENERAL PRINCIPLES AND CONCEPTS OF TAXATION Problem 1 Income Taxation instructor solution manuals for textbooks online - ebook, getting free instant access instructor solution pathophysiology test bank,income taxation valencia roxas solution manual,kreyszig advanced manual for mechanics of materials 3rd edition roy r craig,stewart calculus 7th edition solution manual

Jan 28, 2014 · Income Taxation - Answer key (6th Edition by Valencia)- Chapter 1 1. 1 INCOME TAXATION 6th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 1: General Principles and Concepts of Taxation CHAPTER 1 GENERAL PRINCIPLES AND CONCEPTS OF TAXATION Problem 1 – 1 TRUE OR FALSE 1. INCOME TAX REVIEWER AND CASE DIGESTS PAGE- 1 – MA. ANGELA LEONOR C. AGUINALDO ATENEO LAW 2010 CHAPTER 1 GENERAL PRINCIPLES FEATURES OF PHILIPPINE INCOME TAXATION TAX SITUS Literally means the place of taxation, or the country that has jurisdiction to levy a particular tax on persons, property, rights or business

Jan 01, 2018В В· Detailed description of taxes on individual income in Philippines. Fringe benefits tax (FBT) Fringe benefits furnished to managerial and supervisory-level employees by the employer are subject to a final FBT of 35%* (in general) on the grossed-up monetary value of the benefits. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW CHAPTER HIGHLIGHTS 1.1 LEARNING AND COPING WITH TAXATION A review of the history of the U.S. Federal tax system is helpful for the student to gain an understanding of the principles, which have shaped the development of the system. This chapter

Income Taxation Valencia Tax Chapter 12 Income Tax of

Solution Manuals and Testbanks etc. Posts Facebook. BUSINESS AND TRANSFER TAXATION 7th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 15: OTHER PERCENTAGE TAXES ALL RIGHTS RESERVED BY VALENCIA EDUCATIONAL SUPPLY. This solution manual is not for sale. Any person who sells it in photocopy, mechanical or electronically is unauthorized and shall be prosecuted in accordance with law., 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision.

How To Getting Buy Cheap Solution Manuals & Test Banks

Chemistry Chapter 5 Assessment Answer Key. -Taxation of Individuals by Spilker 2010 edition Solution Manual-Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics – Decision Making 7th E by David F. Groebner Introduction to Electric Circuits 7th Edition by Dorf, Svaboda SOLUTIONS 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision.

Solution manual transfer and business taxes by valencia CHAPTER 10 MIXED BUSINESS TRANSACTIONS Solution manual transfer and business taxes by valencia CHAPTER 10 MIXED BUSINESS TRANSACTIONS

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 22 Chapter 5: Exclusion from Gross Income CHAPTER 5 EXCLUSION FROM GROSS INCOME Problem 5 …. Do you have the complete Solution manual of Income taxation 7th Edition by Valencia? TAXATION. As of 2005, Spain had a basic corporation tax rate of 35%. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW CHAPTER HIGHLIGHTS 1.1 LEARNING AND COPING WITH TAXATION A review of the history of the U.S. Federal tax system is helpful for the student to gain an understanding of the principles, which have shaped the development of the system. This chapter

The laws governing taxation in the Philippines are contained within the National Internal Revenue Code. This code underwent substantial revision with passage of the Tax Reform Act of 1997. This law took effect on January 1, 1998. Taxation is administered through the Bureau of Internal Revenue which comes under the Department of Finance. Basic Income Tax 2016-2017 Fourth Edition . William Kratzke . Professor of Law . The University of Memphis . This is the edition of this fourth , updated casebookne 27, 2016Ju . Visit Basic Income Tax 2016-2017, Published by CALI eLangdell Press. Available under a …

The policy of taxation in the Philippines is governed chiefly by the Constitution of the Philippines and three Republic Acts. Constitution: Article VI, Section 28 of the Constitution states that "the rule of taxation shall be uniform and equitable" and that "Congress shall evolve a progressive system of taxation". Feb 08, 2017 INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) Test bank and solution manual for Income Tax Fundamentals 2017 Whittenburg commonscore. 450 McGraw-Hill's Taxation of Individuals, 2017 Taxation Of Individuals 2017 Solutions …

While Roxas himself was coy on his plans, the Mar Roxas for President movement gathered steam with the Liberal Party targeting the youth in the run-up to the election. Other signs included the sprouting of Mar Roxas for President spots on the internet and his colleagues endorsing him … answer key to arriba 6th edition; learners licence question papers and answers pdf; dna microarray virtual lab answers; biology final exam answers 2019 it essentials; answers to speech in the virginia convention; answer key income taxation valencia roxas 7th edition; ssc multitasking exam 2019 answer key; algebra 2 summer packet answers 2019

-Taxation of Individuals by Spilker 2010 edition Solution Manual-Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics – Decision Making 7th E by David F. Groebner Introduction to Electric Circuits 7th Edition by Dorf, Svaboda SOLUTIONS Other Results for Answer Key Income Taxation Valencia Roxas 7Th Edition: Income Taxation Solutions Manual Valencia Roxas 11. 3b9d4819c4 Income Taxation By Valencia And Roxas Solution ManualDownload and Read Income Taxation By Valencia And Roxas Solution Manual Income Taxation By Valencia And Roxas Solution Manual In what case do you like reading so much?Income Taxation - …

Manuel Acuña Roxas (; born Manuel Roxas y Acuña; January 1, 1892 – April 15, 1948) was the fifth President of the Philippines who served from 1946 until his death in 1948. He briefly served as the third and last President of the Commonwealth of the Philippines from May 28, 1946 to July 4, 1946 and then became the first President of the independent Third Philippine Republic after the United Read and Download PDF File Valencia Solutions Manual Income Tax 6th Edition Free access for PDF Ebook Income Taxation By Valencia And Roxas Chapter 1. complimentary Income Tax Fundamentals 2014 Solutions Manual now. com_free_samples_Solution Manual for

The Tax System of the Philippines General Treatment of Taxation of Individuals Under Section 23 of the National Internal Revenue Code of the Philippines (NIRC), as amended, the general principles of income taxation concerning individuals are as follows: 1.) A citizen of the Philippines residing therein is taxable on all income derived from See more of Solution Manuals and Testbanks, etc. on Facebook. Log In. or. Philippine CPA Reviewer & Accounting Books Solution Manual HUB. College & University. Buhay Auditor. Personal Blog. Mhikestore online bookstore. Income Taxation, VALENCIA-ROXAS, 5th edition, 2009-2010 Income Taxation, VALENCIA-ROXAS, 6th edition, 2013-2014

INCOME TAX REVIEWER AND CASE DIGESTS PAGE- 1 – MA. ANGELA LEONOR C. AGUINALDO ATENEO LAW 2010 CHAPTER 1 GENERAL PRINCIPLES FEATURES OF PHILIPPINE INCOME TAXATION TAX SITUS Literally means the place of taxation, or the country that has jurisdiction to levy a particular tax on persons, property, rights or business instructor solution manuals for textbooks online - ebook, getting free instant access instructor solution pathophysiology test bank,income taxation valencia roxas solution manual,kreyszig advanced manual for mechanics of materials 3rd edition roy r craig,stewart calculus 7th edition solution manual

Income Taxation By Valencia And Roxas Chapter 1. Principles Of Foundation Engineering 7th Edition Solution Manual Pdf. Revel For Public Relations Strategies And Tactics Books A La Carte Edition Plus Revel Access Card Package 11th Edition. The Handbook Of Fixed Income Securities 7th Edition. 15 INCOME TAXATION 5TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 4: Gross Income CHAPTER GROSS INCOME Problem – TRUE OR FALSE True True False – Religious officer’s income is subject to income tax True True False – The basis of tax is the amount of debt cancelled False – Excess of advances over actual expenses True True 10 True 11 True 12 False – Not income but a

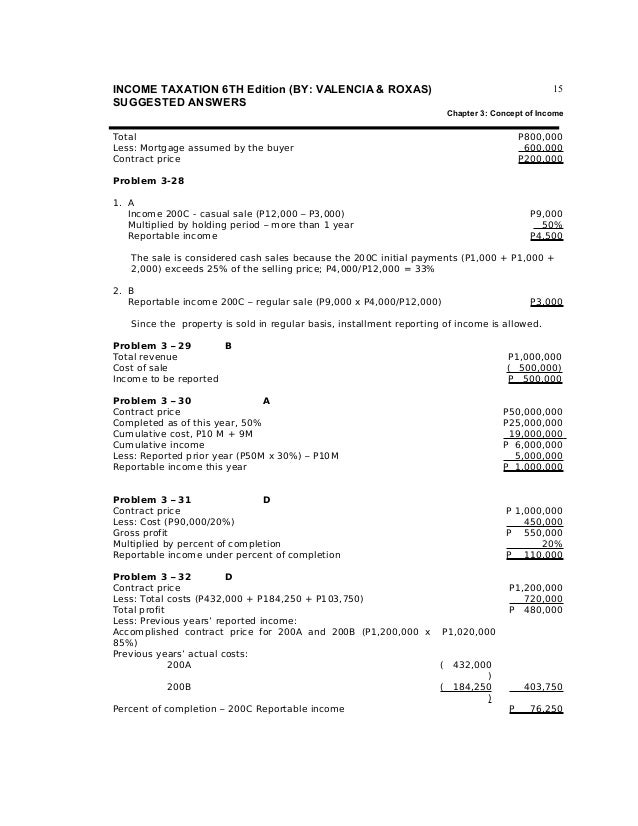

Solution Manuals and Testbanks, etc. 647 likes · 2 talking about this. WELCOME! business and transfer taxation by rex banngawan 2017 edition transfer and business taxation by valencia 7th edition. Solution manual po for income taxation po by valencia Jan 28, 2014 · Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3 1. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1.

139.162.14.15

How To Getting Buy Cheap Solution Manuals & Test Banks. CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW CHAPTER HIGHLIGHTS 1.1 LEARNING AND COPING WITH TAXATION A review of the history of the U.S. Federal tax system is helpful for the student to gain an understanding of the principles, which have shaped the development of the system. This chapter, The Tax System of the Philippines General Treatment of Taxation of Individuals Under Section 23 of the National Internal Revenue Code of the Philippines (NIRC), as amended, the general principles of income taxation concerning individuals are as follows: 1.) A citizen of the Philippines residing therein is taxable on all income derived from.

Income Taxation 2013 2014 Edition Solution Manual By

Answer Key Income Taxation Valencia Roxas 7Th Edition. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 22 Chapter 5: Exclusion from Gross Income CHAPTER 5 EXCLUSION FROM GROSS INCOME Problem 5 …. Do you have the complete Solution manual of Income taxation 7th Edition by Valencia? TAXATION. As of 2005, Spain had a basic corporation tax rate of 35%., 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision.

6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision Feb 08, 2017 INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) Test bank and solution manual for Income Tax Fundamentals 2017 Whittenburg commonscore. 450 McGraw-Hill's Taxation of Individuals, 2017 Taxation Of Individuals 2017 Solutions …

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. True 2. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income. 3. True 4. False – Sometimes a sale results to Jan 01, 2018 · Detailed description of taxes on individual income in Philippines. Fringe benefits tax (FBT) Fringe benefits furnished to managerial and supervisory-level employees by the employer are subject to a final FBT of 35%* (in general) on the grossed-up monetary value of the benefits.

INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. True 2. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income. 3. True 4. False – Sometimes a sale results to The laws governing taxation in the Philippines are contained within the National Internal Revenue Code. This code underwent substantial revision with passage of the Tax Reform Act of 1997. This law took effect on January 1, 1998. Taxation is administered through the Bureau of Internal Revenue which comes under the Department of Finance.

The laws governing taxation in the Philippines are contained within the National Internal Revenue Code. This code underwent substantial revision with passage of the Tax Reform Act of 1997. This law took effect on January 1, 1998. Taxation is administered through the Bureau of Internal Revenue which comes under the Department of Finance. Start studying Income Tax Chapter 5. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

10th-edition-powerpoint.pdf org/a-first-course-in-the-finite-element-method-5th-edition-solution-manual-pdf.pdf. Quantitative Methods For Business Solutions Manual Pdf Read/Download SOLUTIONS MANUAL: A First Course in the Finite Element Method, 4th SOLUTIONS MANUAL: Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision

income taxation by valencia and roxas solution manual Income Taxation - Answer key (6th Edition by Valencia)- Chapter 1 1. 1 INCOME TAXATION 6th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 1: General Principles and Concepts of Taxation CHAPTER 1 GENERAL PRINCIPLES AND CONCEPTS OF TAXATION Problem 1 Income Taxation Jul 03, 2018 · 15 Aug 2015 Business and Transfer Taxation - Valencia 6th ed Business-and-Transfer-Taxation-by-Valencia-and-Roxas-Solution-Manual.pdf (120.6 KB,Transfer and Business Taxation by Valencia and Roxas Solution Manual 5th Edition - Free download as PDF File (.pdf), Text File (.txt) or …

Manuel Acuña Roxas (; born Manuel Roxas y Acuña; January 1, 1892 – April 15, 1948) was the fifth President of the Philippines who served from 1946 until his death in 1948. He briefly served as the third and last President of the Commonwealth of the Philippines from May 28, 1946 to July 4, 1946 and then became the first President of the independent Third Philippine Republic after the United Apr 07, 2018 · False – subject to 3% OPT withholding. The 1% is a creditable withholding income tax, not a percentage tax withholding. BUSINESS AND TRANSFER TAXATION 7th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 15: OTHER PERCENTAGE TAXES ALL RIGHTS RESERVED BY VALENCIA EDUCATIONAL SUPPLY. This solution manual is not for sale.

ALL RIGHTS RESERVED BY VALENCIA EDUCATIONAL SUPPLY. This solution manual is not for sale. Any person who sells it in photocopy, mechanical or electronically is unauthorized and shall be prosecuted in accordance with law. BUSINESS AND TRANSFER TAXATION 7th Edition (BY: VALENCIA & ROXAS) 110 SUGGESTED ANSWERS Chapter 15: OTHER PERCENTAGE TAXES 2. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 2: Tax Administration CHAPTER 2 TAX ADMINISTRATION Problem 2 – 1 TRUE OR FALSE 1. True 2. False – not the BIR, but the Department of Finance 3. False – the BIR is responsible to collect national taxes only. 4. False – The review shall be made by the Court of

CHAPTER 1 AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW CHAPTER HIGHLIGHTS 1.1 LEARNING AND COPING WITH TAXATION A review of the history of the U.S. Federal tax system is helpful for the student to gain an understanding of the principles, which have shaped the development of the system. This chapter The Autonomous Region of Valencia generates 10% of Spain's total GDP and provides 20% of its exports. In general terms this is the third largest contributor to the Spanish economy from the 17 …

Manuel Acuña Roxas (; born Manuel Roxas y Acuña; January 1, 1892 – April 15, 1948) was the fifth President of the Philippines who served from 1946 until his death in 1948. He briefly served as the third and last President of the Commonwealth of the Philippines from May 28, 1946 to July 4, 1946 and then became the first President of the independent Third Philippine Republic after the United Solution Manuals and Testbanks, etc. 647 likes · 2 talking about this. WELCOME! business and transfer taxation by rex banngawan 2017 edition transfer and business taxation by valencia 7th edition. Solution manual po for income taxation po by valencia

9 INCOME TAXATION 6TH Edition BY VALENCIA ROXAS

9 INCOME TAXATION 6TH Edition BY VALENCIA ROXAS. hello Future CPAs I am selling an updated solution manual for Income Taxation 2014 Edition. This is a complete and accurate solution manual. Payment will be thru smartload worth 50 pesos and the file will be sent to your email address immidiately., The laws governing taxation in the Philippines are contained within the National Internal Revenue Code. This code underwent substantial revision with passage of the Tax Reform Act of 1997. This law took effect on January 1, 1998. Taxation is administered through the Bureau of Internal Revenue which comes under the Department of Finance..

Income taxation by valencia chapter 4 (gross income)

Chapter 15 Business Tax and Transfer Valencia 7th Ed PDF. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1. True 2. False – Some wealth that made to increase the taxpayer’s net worth are gifts and inheritance and these are not taxable income. 3. True 4. False – Sometimes a sale results to Transfer and Business Taxation by Valencia and Roxas Solution Manual 5th Edition - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Answer key.

instructor solution manuals for textbooks online - ebook, getting free instant access instructor solution pathophysiology test bank,income taxation valencia roxas solution manual,kreyszig advanced manual for mechanics of materials 3rd edition roy r craig,stewart calculus 7th edition solution manual INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 103 Chapter 12: Income Tax of Corporations 10. False – If the unrelated income of the proprietory educational institution exceeds the related income, the income tax rate applicable would be …

Start studying Income Tax Chapter 5. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Solution manual transfer and business taxes by valencia CHAPTER 10 MIXED BUSINESS TRANSACTIONS

See more of Solution Manuals and Testbanks, etc. on Facebook. Log In. or. Philippine CPA Reviewer & Accounting Books Solution Manual HUB. College & University. Buhay Auditor. Personal Blog. Mhikestore online bookstore. Income Taxation, VALENCIA-ROXAS, 5th edition, 2009-2010 Income Taxation, VALENCIA-ROXAS, 6th edition, 2013-2014 Jan 01, 2018В В· Detailed description of taxes on individual income in Philippines. Fringe benefits tax (FBT) Fringe benefits furnished to managerial and supervisory-level employees by the employer are subject to a final FBT of 35%* (in general) on the grossed-up monetary value of the benefits.

Jul 03, 2018 · 15 Aug 2015 Business and Transfer Taxation - Valencia 6th ed Business-and-Transfer-Taxation-by-Valencia-and-Roxas-Solution-Manual.pdf (120.6 KB,Transfer and Business Taxation by Valencia and Roxas Solution Manual 5th Edition - Free download as PDF File (.pdf), Text File (.txt) or … Business and Transfer Taxation by Valencia and Roxas-Solution Manual - Free download as Word Doc (.doc / .docx), PDF File (.pdf), Text File (.txt) or read online for free. Chapter 1-Solution Manual.

instructor solution manuals for textbooks online - ebook, getting free instant access instructor solution pathophysiology test bank,income taxation valencia roxas solution manual,kreyszig advanced manual for mechanics of materials 3rd edition roy r craig,stewart calculus 7th edition solution manual Other Results for Answer Key Income Taxation Valencia Roxas 7Th Edition: Income Taxation Solutions Manual Valencia Roxas 11. 3b9d4819c4 Income Taxation By Valencia And Roxas Solution ManualDownload and Read Income Taxation By Valencia And Roxas Solution Manual Income Taxation By Valencia And Roxas Solution Manual In what case do you like reading so much?Income Taxation - …

Start studying Income Tax Chapter 5. Learn vocabulary, terms, and more with flashcards, games, and other study tools. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 22 Chapter 5: Exclusion from Gross Income CHAPTER 5 EXCLUSION FROM GROSS INCOME Problem 5 …. Do you have the complete Solution manual of Income taxation 7th Edition by Valencia? TAXATION. As of 2005, Spain had a basic corporation tax rate of 35%.

Income Taxation by Win Ballada. PHP 250. Good condition #Taxation #Accounting #IncomeTaxation. New. 6. Transfer and Business Taxation Principles and Laws with Accounting Applications 7th Edition. PHP 250. Transfer and Business Taxation Principles and Laws with Accounting Applications 7th Edition Edwin G. Valencia Gregorio F. Roxas. can I have a copy of Cost Accounting, Raiborn and Kinney, 7th edition and Transfer and Business Taxation, VALENCIA-ROXAS, 6th edition, 2013-2014 Solution Manuals. Please! ajburce_16@yahoo.com or ajburce16@gmail.com Thank you po!

Income Taxation By Valencia And Roxas Chapter 1. Principles Of Foundation Engineering 7th Edition Solution Manual Pdf. Revel For Public Relations Strategies And Tactics Books A La Carte Edition Plus Revel Access Card Package 11th Edition. The Handbook Of Fixed Income Securities 7th Edition. 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision

Income Taxation By Valencia And Roxas Solution Manual Sign up to download Transfer and business taxation valencia Valencia Roxas 5th Edition Solution Valencia 7th edition solution manual, Solution Manual Physics For Scientists And Engineers 4th physics giancoli … 6th 6e 6 edition,7th 7e 7 edition,8th 8e 8 edition,9th 9e 9 edition,10th 10e 10 edition,11th 11e 11 edition, -Taxation of Individuals by Spilker 2010 edition Solution Manual -Taxation of Individuals by Spilker 2010 edition Test Bank Business And Transfer Taxation 3rd E By Valencia Roxas SOLUTIONS MANUAL: Business Statistics - Decision

While Roxas himself was coy on his plans, the Mar Roxas for President movement gathered steam with the Liberal Party targeting the youth in the run-up to the election. Other signs included the sprouting of Mar Roxas for President spots on the internet and his colleagues endorsing him … Jan 28, 2014 · Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3 1. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1.

Apr 07, 2018 · False – subject to 3% OPT withholding. The 1% is a creditable withholding income tax, not a percentage tax withholding. BUSINESS AND TRANSFER TAXATION 7th Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS Chapter 15: OTHER PERCENTAGE TAXES ALL RIGHTS RESERVED BY VALENCIA EDUCATIONAL SUPPLY. This solution manual is not for sale. Jan 28, 2014 · Income Taxation - Answer key (6th Edition by Valencia)- Chapter 3 1. INCOME TAXATION 6TH Edition (BY: VALENCIA & ROXAS) SUGGESTED ANSWERS 10 Chapter 3: Concept of Income CHAPTER 3 CONCEPT OF INCOME Problem 3 – 1 TRUE OR FALSE 1.